June 13, 2023

June 13, 2023

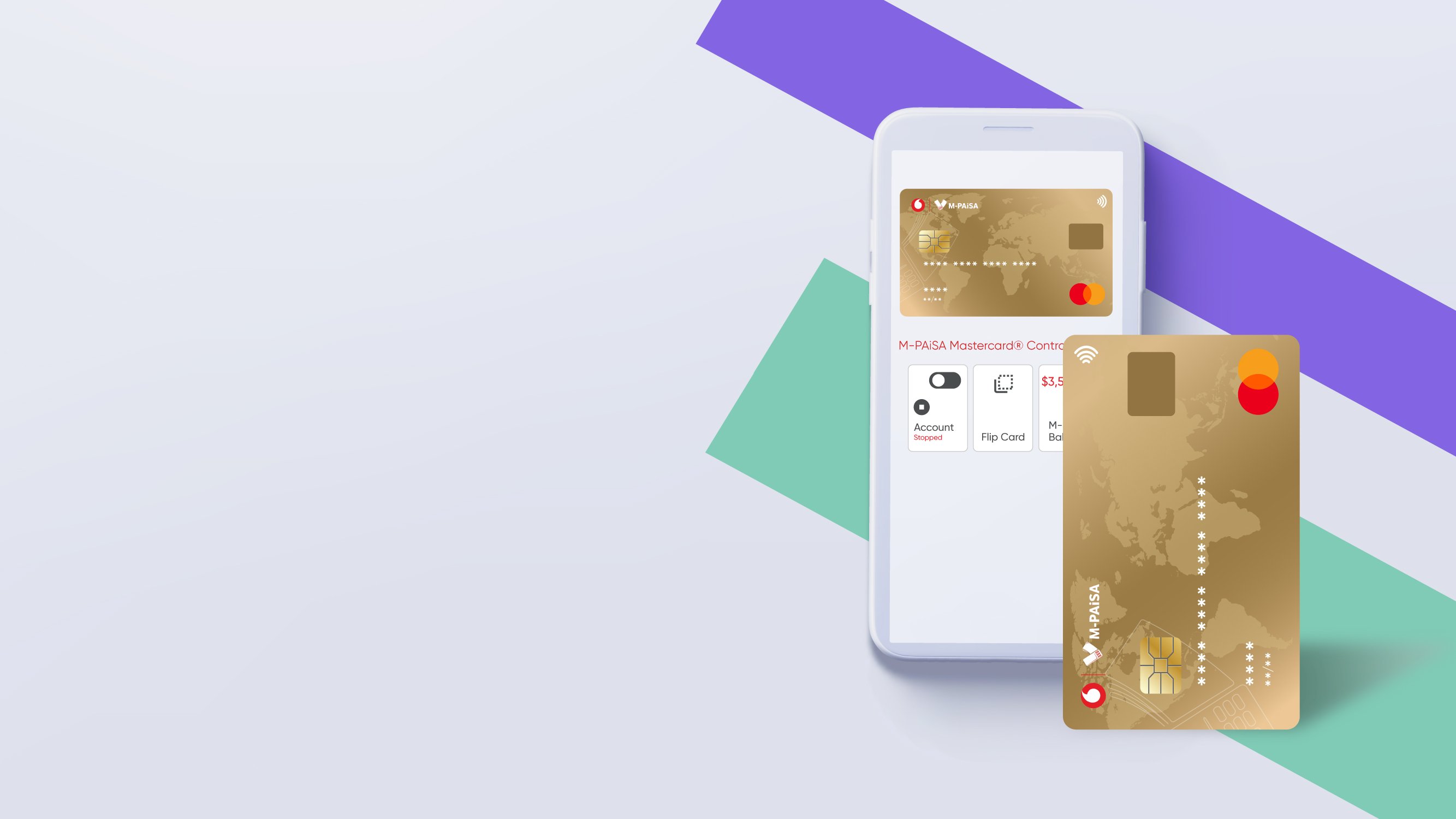

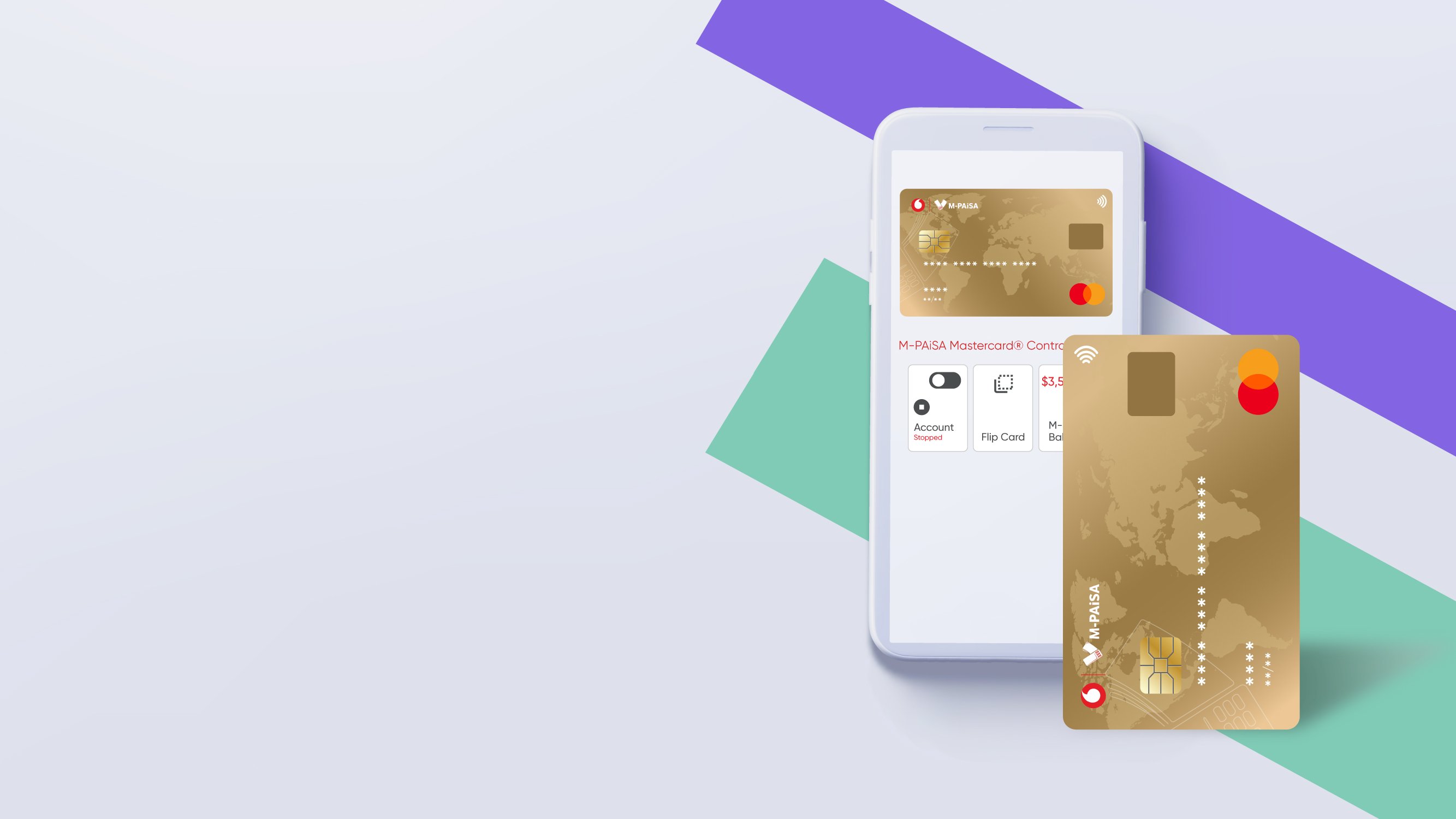

13 June, London: Paymentology, the leading global issuer-processor, today announces its continued partnership with Vodafone Fiji as it evolves its M-PAiSA mobile wallet to now issue Mastercard digital first cards to its customers via the M-PAiSA app, enabling seamless cross-border and online payments.

Vodafone Fiji Pte Limited is a 100% locally owned entity, of which 51% is owned by Amalgamated Telecommunications Holdings and 49% by Fiji National Provident Fund. Since the introduction of its inaugural closed loop mobile wallet solution in 2010 it has now evolved into a fully-fledged open-loop payment service platform and is considered one of the largest systemic payment platforms in Fiji. It offers a full suite of features such as utility payments, instore QR payment, remote payments, cross border remittance and internet payment gateway services.

Paymentology is providing Vodafone Fiji the crucial connectivity to establish a gateway to the Mastercard global network for the issuing of M-PAiSA Mastercard debit cards. The partnership utilises smart APIs and a pre-established technology stack to authorise and process Mastercard payments. With the assistance of Paymentology, Vodafone Fiji can now provide its customers with a secure and seamless payment experience, while managing sophisticated operations by exempting Vodafone from the complexities of global payment connectivity and compliance for faster deployment.

The announcement comes as credit and debit card usage in Fiji lags behind that of developed markets, presenting a significant disparity. Recent surveys have revealed that a considerable proportion of Fijians face difficulties obtaining scheme cards for cross-border payments and participating in a digital economy. Now thanks to the onboarding of M-PAiSA Mastercard, customers have the ability to apply through the M-PAiSA App without the need to visit any of the outlets.

Deepak Baran Head of Fintech at Vodafone commented on the announcement: "We are thrilled to continue our collaboration with Paymentology as our chosen issuer processing partner, their fundamental platform capabilities such as compliance, speed, data, customisation, and security are unparalleled. Plus, their unrivalled local knowledge and unwavering commitment to financial inclusion have played an essential role in our achievements. Together, we are shaping a future where financial opportunities are accessible to all Fijians, and making great progress towards fully embracing the flourishing digital economy.”

Emre Durusut Regional Director APAC at Paymentology continued: “We’re incredibly proud to support this next stage of Vodafone Fiji’s financial services evolution. This move has not only diversified their revenue streams but has also reduced their reliance on conventional communication services, which are now considered mature products. Vodafone continues to explore new boundaries in the mobile world, and with our support has not only unlocked new markets but has also made significant strides in promoting financial inclusion. We look forward to continuing to pave the way for a more inclusive and technologically advanced future together.”