July 20, 2023

July 20, 2023

Paymentology’s card issuing platform and analytics capabilities support PayCard in providing financial services to a 75% unbanked population in the Republic of Guinea

20 July, London: Paymentology, the leading global issuer-processor, today announces its partnership with PayCard, a FinTech offering an innovative e-wallet solution linked to a prepaid card in the Republic of Guinea, in West Africa.

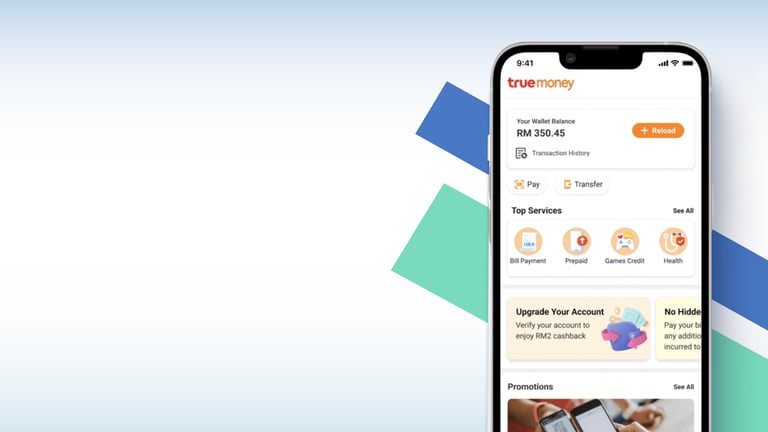

PayCard, launched this month, enables an electronic wallet accompanied by a payment card, providing convenient and cashless transfers of funds and payments. Historically extensive documents have been needed in Guinea to open a bank account, now users can download the PayCard app on their Android or iPhone devices, verify their identity, and order either a physical or virtual card to begin transacting worldwide.

The launch of PayCard has been made possible through strategic partnerships with Paymentology, leading pan-African bank Ecobank, and payments giant Visa. With Paymentology's support, PayCard is now connected to the Visa rails, harnessing Paymentology's real-time data feed to gain valuable insights into customer spending patterns. This empowers PayCard to continuously enhance its offerings and personalise services for end-users.

With 75% of the 13.5 million population unbanked, the introduction of PayCard Visa cards highlights the shared commitment of PayCard and Paymentology to foster financial inclusion in Guinea and in the region. With a significant portion of the population lacking access to traditional banking services, underserved communities can now leverage mobile money solutions to send and receive funds, pay bills, and access essential financial services.

Commenting on the partnership, Kirsten Wortmann, Regional Director for Africa at Paymentology said: “We are extremely proud to support PayCard through our next generation payment platform which facilitates connectivity with the Visa network. Our collaboration with PayCard reflects our commitment to partner with innovative fintechs that are leading the way toward financial inclusion. Together, we enable users to take control of their financial life and we look forward to the continuation of this partnership which will enable the launch of new and ever more innovative next generation services.”

Fatou Diarra, General manager of PayCard, added: “Enabling individuals to engage in financial transactions, such as making payments and receiving funds, serves as an initial milestone for serving unbanked populations, preceding their progression towards enhancing their creditworthiness and accessing a broader range of financial opportunities.

“Together with Paymentology, Visa and EcoBank we are providing the underserved in Guinea with a card that is safe, secure and accessible for all users. We’re delighted to have launched and look forward to leveraging Paymentology's expertise in payment processing and innovative solutions and continue to offer advanced features that meet the evolving needs of our customers.”