Pro

The next level for banks and ambitious fintechs

Extreme flexibility, data-richness, and scalability, with true global reach.

The leading in-Cloud solution for digital banks and high-performing fintechs.

Trusted by industry leaders, game-changers, and their proven apps.

More power. More data.

More possibilities

Create and rapidly deploy finely tuned payment products, with the most sophisticated Platform and the richest data.PayRule Decision Engine

PayRule Decision Engine’s unrivalled flexibility gives you the ultra-granular product control to do business on your exact terms.

Rich, real-time data

We provide more than 120 lines of rapid, meaningful, layered data; actionable even at POS-level.

Credit and tokenisation

Offer leading card products and services; including credit, tokenisation, physical and digital cards, and more.

Offer today’s leading card products

Issue highly tailored virtual and physical card products, easily and at scale, anywhere in the world.

Debit cards

Prepaid cards

Tokenisation

Digital-first, numberless cards

Multi-currency made simple

Debit cards

Issue digital Visa or Mastercard debit cards, with full control over how they are used, and the option to issue physical cards too.

Prepaid cards

Issue funds to customers, employees and other recipients safely and easily, with preloaded cards that are fully secure and easy to use.

Tokenisation

Push tokens to all leading Pay wallets. With cardholder token control, and sensitive details never exposed, tokenisation is the next evolution in security.

Digital-first, numberless cards

The next evolution in privacy; combining app-based customer card-control, and physical cards displaying no sensitive cardholder details.

Multi-currency made simple

We process across multiple regions, in any currency. Now, you can offer and deliver multi-currency products and value-adds, easily and rapidly.

Credit

Issue, manage and control credit products, at scale. Design, innovate and deploy products and services, with unprecedented configurability and agility.

Revolving credit

Instalments

Buy Now Pay Later

Revolving credit

Enable all the capabilities associated with “traditional” revolving credit, at the highest possible level, with design and deployment made simple.

Instalments

Trigger post-purchase offers to convert a portion of a credit balance into instalments, when customers are eligible, according to your rules.

Buy Now Pay Later

Offer a range of Buy Now Pay Later (BNPL) products, giving you more business opportunities, and your customers more options.

Richer data. Deeper insights

Paymentology FAST Message provides over 120 transaction details, in a rich, layered, easily interpretable, real-time feed. Not only more data than our competitors, but smarter, faster, and more actionable, too.

FAST is Paymentology’s “Framework for Authorisation and Settlement Transmission” interface. It empowers meaningful participation in the authorisation message; providing enriched, full-scheme messaging with enhanced spend-analytics.

Active participation

Passive participation

Choose your format

FAST setup assistance

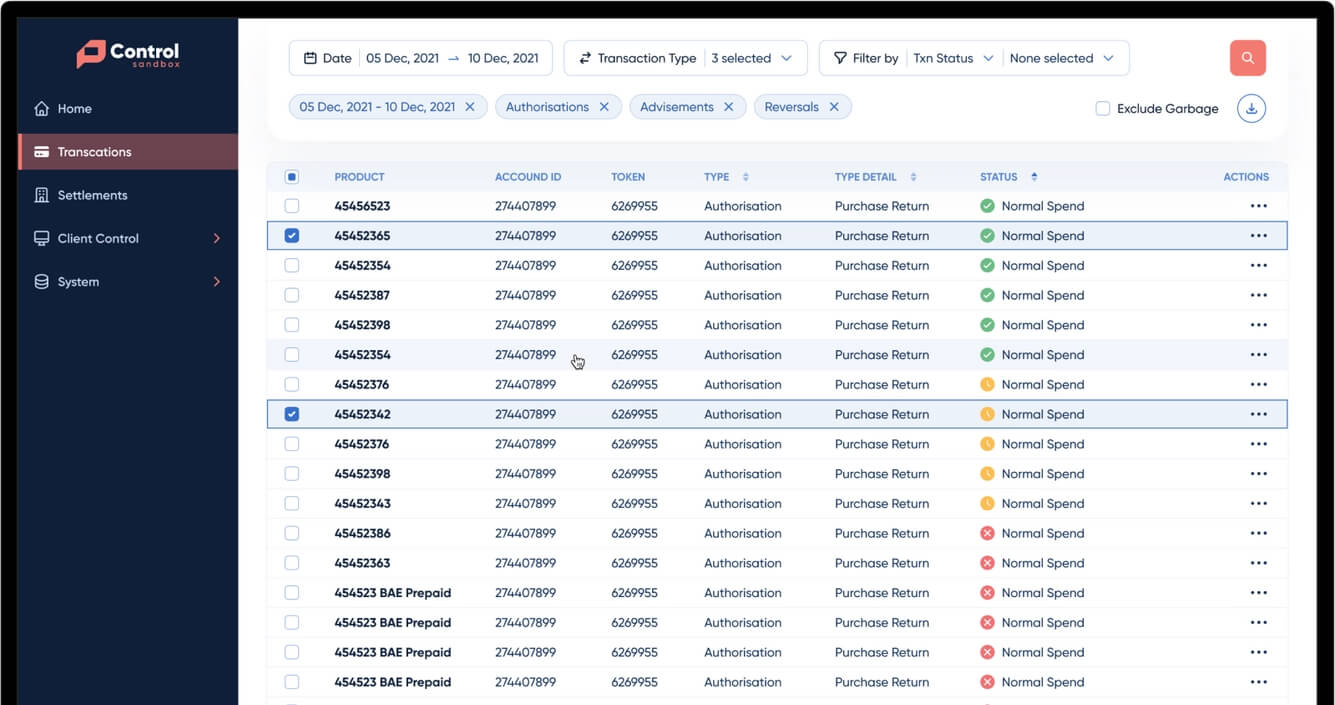

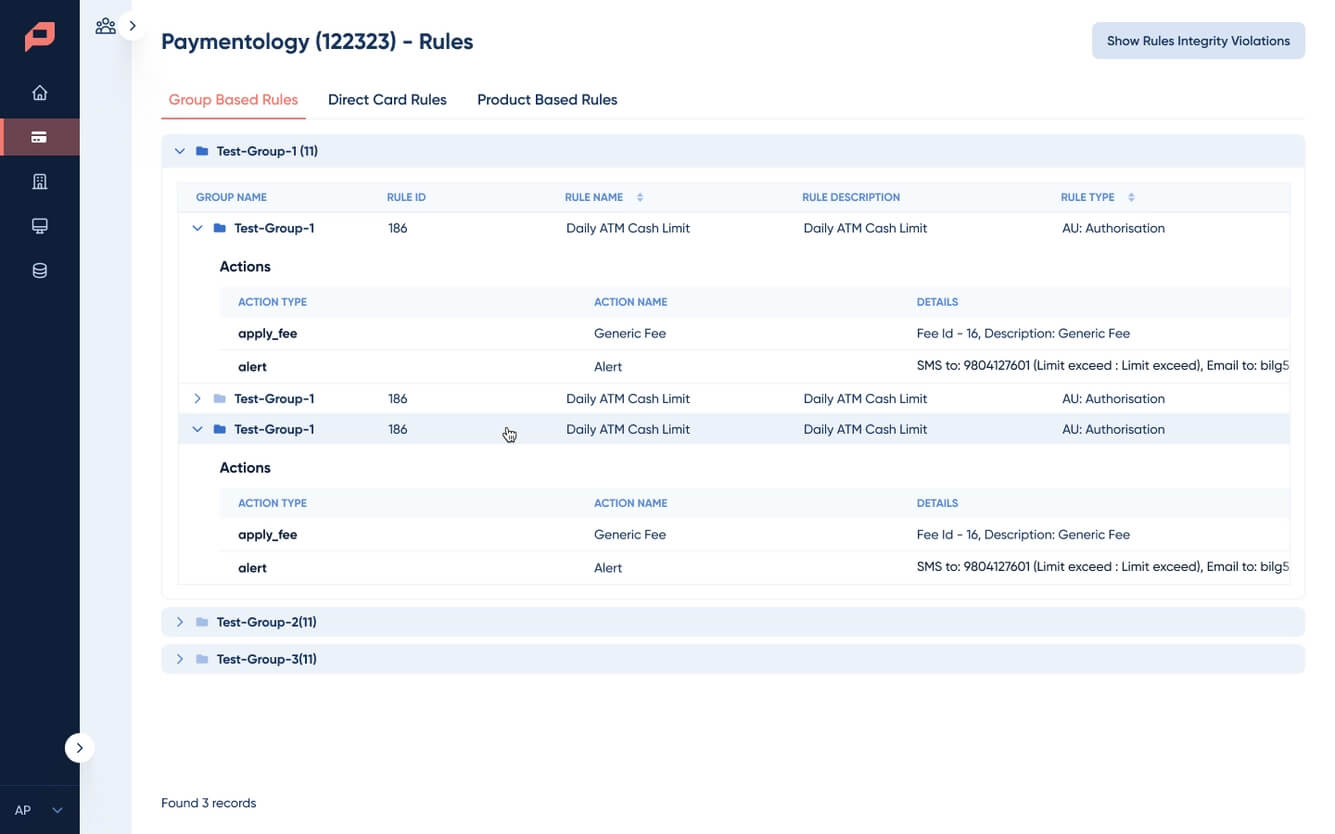

Decision Engine

PayRule Engine has extensive flexibility and empowers rule control at almost any level; including card, customer, merchant, and many others.

Set fraud rules to allow dynamic assessment of fraud-scenarios, in real-time.

Configure and customise rules at an ultra-granular level, with PayRule Engine.

Cloud-native scalability

With everything in the Cloud, nothing needs to be taken offline or disrupted to create or fine-tune programmes, or increase transaction capacity as you scale.Shared Cloud

The cost-effective, fast-to-market, frictionless solution.

Our Cloud capabilities are highly scalable. Always ready to rapidly expand, as you grow.

We don't just comply with best practices. We set the benchmark.

We achieve virtually no downtime, with our ultra-smart active/active clustering solution.

Integrate into all major Cloud systems, including AWS, Google Cloud, Oracle, Microsoft Azure, and more.

Rapid time-to-market

We have extensive experience integrating into numerous traditional and modern core banking systems, including Mambu, Thought Machine, 10x Banking, and more.Frictionless integration and migration.

We ensure rapid, seamless, low-friction integration and migration, thanks to our extensive experience, benchmark-setting best practices, and ultra-flexible APIs.

Create cards instantly with the most powerful, most secure APIs

Superior capability.

Powerful APIs

Our APIs are more sophisticated, more secure, more flexible, and more comprehensive, out of the box.

{

client_id: 760131,

user_id:760131,

remarks:“Creating card For Customer“,

input_type:“t“,

input_id:520872406,

api_call_unique_identifier: 438574845790657485,

}

Test products in minutes

Decrease second-line fraud disputes

Protect data with Maker and 2FA

You decide.

PayControl

Your portal to control rules, issue cards and manage your own programmes.

Detailed system logs

Optimise back-office expenses

Easily understandable data

Other great built-in features

A wide variety of products

Offer travel cards, commercial cards, single cards linked to multiple accounts, multiple cards linked to single accounts, loyalty and rewards, and numerous credit products.

Deploy into any Cloud

We can deploy programmes into any major Cloud scheme that suits your needs, smoothly and fast.

Low-latency

With geo-strategic processing, we offer consistent, high transaction speeds and uptime, wherever you’re based.

Dispute management

We're on hand to provide support in the event of disputes, including chargeback claims and more.

Reliable reporting

We provide all the data you need to manage reconciliation and optimise your programme.

3DS

Approve legitimate transactions through native mobile integration, to minimise e-commerce fraud.

User privacy

Our systems are fully compliant with General Data Protection Regulation (GDPR) guidelines, as well as all Mastercard and Visa standards.

Certification made simple

We’re PCI DSS Level-1 compliant, meaning we take care of all the certification “heavy-lifting” for you.

After-sales service

We partner for the longterm. From launch phase, through exponential growth, to fulfilment of your vision and beyond, we're by your side, all the way.

24/7 global support

With expert Paymentologists and Support Teams on the ground, all around the world, we’re on hand, at all times.

Contact us

Our payment experts are on hand to guide you, answer your questions, and get you up and running, fast.

Pro: commonly asked questions

In which countries is Pro available?

Pro is available worldwide.

Which cards does Pro support?

Pro supports prepaid, credit, and debit cards, both physical and virtual.

Does Pro require BIN sponsorship?

Yes, BIN sponsorship is required to start issuing cards.

Does Pro offer domestic switch integration?

Yes, Paymentology Pro offers the possibility to integrate with domestic switches where needed.

What type of credit solutions does Pro offer?

Pro offers a wide variety of credit solutions including revolving credit, Buy Now Pay Later, and Merchant Funded Instalments.

Does Paymentology offer other options?

Yes, we have three other products: Flex, Sprint, and Enterprise.

Still not sure if Pro is the right fit for you?

Available

South Africa

Worldwide

excluding on-soil countries

Worldwide

Worldwide

no restrictions

Processing

Processing instance

Prepaid-card processing

Debit-card processing

Start innovating your payments with us

Speak to a payments expert in your region and we'll get you informed, up, and running, quickly and easily.